You saw Best Buy’s Super Bowl commercial with a stumbling Ozzy Osbourne and a weird kid celebrity, by the name of Bieber, who was called a “girl” by the end of it. Just what was that horrendous attempt at a futuristic looking Buy Back Program really all about?

In short, it is Best Buy’s newest attempt to sell its customers a useless exchange program that will surely suck more of the monetary life out of the naïve techy in all of us who cannot say “no” to Best Buy employees.

Does anyone, in any walk of life, have any actual need for the Best Buy Buy Back Program: NO! I am normally all for recycling programs, but this is simply a money scheming insanity plea.

Let us take a really close look at the minute details of this bizarre new twist in Best Buy’s product selling techniques, so that you, the consumer, can see what service, if any, is being provided to you.

Best Buy, if you did not know this, makes much of their profit selling their company’s personalized Warranty programs. Most of the time, their products hold up, at least as long as their all too often short warranty lasts, and the company makes a killing. I once purchased outdoor speakers, which were on sale for ten bucks, and I was harassed by an employee to buy an extended warranty of one year for the cheap cost of only thirty dollars. Wait, what?! Yes, it happened.

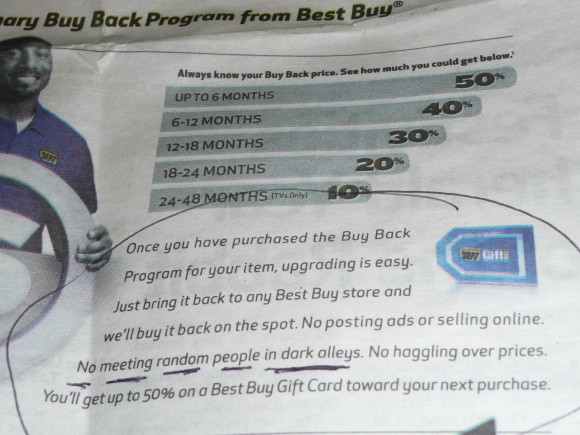

Now the Buy Back Program is being pushed, so that customers who like to be on the cutting edge of the latest technology can trade back newly bought items, up to four years later, for Best Buy gift cards toward their next purchase of far-from-obsolete phones, televisions, tablets and laptops. The problem here is that the consumer is only being ripped off for a 99-dollar fee for the Buy Back Plan purchase, and then, if the product is to be traded back to Best Buy (who will sell it, folks!) the customer gets practically nothing in return.

The scam’s details: Check out their “Frequently Answered Questions” on the Best Buy site. If you want to trade in a cell phone, they will give you a percentage of the retail price, which sounds great right? Let’s say they give you 50% of your (hypothetical) $600 iPhone, $300, toward your next purchase. They claim that you probably did not pay the retail price originally, because when you sign a two year phone contract you get a discounted, let’s say $200, phone. You just made a $100, right? Wrong! You now have to buy a new iPhone at the Retail cost, because months earlier you signed a two-year contract and cannot do so again. Best Buy will give you $300 for your (practically new) phone and then charge you $600 for the newer one.

But wait, you now have the newest and coolest, technologically speaking, calibrated phone for only $300, and that does not sound so bad (sarcasm folks). Did I forget to mention that Best Buy charged you $100 for the Buy Back to begin with. I did, didn’t I? Now, you’ve spent $100 on that plus $300, which equals $400 (I am no math whiz but that is your total), on the newer phone when you could have waited for your own cell phone company to offer you an upgrade (these promotions arise, ad nauseam, at various times every year).

The 50% Buy Back is also a best-case scenario, and is only given for something that is in pristine working condition and returned within six months of purchase. Best Buy appraises everything that you try to use the Buy Back for, and they have two grades: Good and Poor. If they deem your iPhone to be a little too used or scratched up, say you dropped it and gouged the crystalline back a little, then your Buy Back (that you already spent $100 on) is reduced by another 50%. Your $300 Best Buy gift card becomes $150, and you wonder why you spent $100 to return a perfectly usable phone five months after you got it.

Best Buy claims that this is safer and more worth while than selling something on eBay; their advertisement implies that people reselling their things on their own requires: “meeting random people in dark alleys”. What?! Check out the Ad (pictured) from the newspaper, Newsday. I would argue that eBay protects their customers comparably to Best Buy and the potential financial gains are so much greater than the ones provided by this terrible Bieber-Best Buy scam that Best Buy should be ignored with regards to this fallacy.

The analysis is 100% correct. Don’t use the Best Buy buyback program especially because there are much better alternatives like. Let’s take your example and pretend you bought an AT&T 16GB iPhone 4 a few months ago and want to trade for the new Verizon version.

You bought the AT&T iPhone under contract and got it for $199. Six months later you want to trade it in and Best Buy will give you $100 for it (less what you needed to pay to get into the program). If instead you sold that same phone to SellYourCell you could sell it for $370! Actually $170 more than you bought it for instead of $100 less.

That Best Buy ad is funny! Isn’t that what Hookers and Drug Dealers do- Meet Random People in Dark Alleys?!! Ha!

Being a best buy employee I can tell you that the article is entirely wrong actually. Best Buy gives you 50% of the retail price. So for instance you sign a contract and get your 16 GB iPhone for $200 and then get the buy back for $60, the store will then give you $300 in 6 months since $600 is the actual retail price, they don’t give you 50% of what you pay. yeah I completely agree its a really shitty idea for televisions and computers but considering most people can get their phones upgraded once a year they are getting usually their money back to get another phone basically for free!!

I do the same thing free upgrades. They give 270 and i buy my phone for 200 last year….i have my upgrade every year.

100% agreed. Best Buy is too greedy!